Industrial Tech Acquisitions II (ITAQ) to Combine with NXTCLEAN in $530M Deal

Industrial Tech II (NASDAQ:ITAQ) has entered into a definitive agreement to combine with renewable energy producer NEXT Renewable Fuels, Inc. (“NEXT, “NXT” or the “Company”) at an enterprise value of $530 million, or 0.9x its 2025E EBITDA.

Houston-based NEXT is developing plans to build a renewable aviation fuel refinery in Oregon that would supply clients on the West Coast.

The combined company is expected to trade under the name NXTCLEAN Fuels once the deal is completed in the second quarter of 2023.

Transaction Overview

Industrial Tech II has about $176 million in its current trust and it must maintain at least $50 million in cash available in order for the deal to close. NEXT expects to pay $20 million in transaction fees with the remainder of proceeds going to its balance sheet.

United Airlines (NASDAQ:UAL) has agreed to purchase 500,000 NEXT shares at $5 per share and has been issued 4,000,000 warrants to buy more, also at $5 per share. If certain milestones are met, United has agreed to invest up to $37.5 million into the combined company.

The parties also intended to raise up to $50 million in convertible notes, up to $15 million or more of which are to be purchased by United.

Assuming no redemptions, existing NEXT shareholders are expected to own 67.6% of the combined company, with public Industrial Tech II shareholders taking 25.9%. The SPAC’s sponsor would take a 6.5% stake when its promote shares convert.

The company and sponsor have both agreed to a one-year lockup.

Quick Takes: The first thing to understand about NXTCLEAN’s business is that it’s not a business just yet.

NXTCLEAN aims to build a refinery to produce sustainable aviation fuels (SAF), but expects its first revenues to come in 2026. It has access to 600 acres of land in and around Port Westward, Oregon at what is an existing US Army munitions depot.

Once built, the facility could supply all major demand markets on the East Coast with about 50,000 barrels per day in capacity. NXTCLEAN expects to secure final approval to break ground on the site in late 2023, having already gotten through most state-level permitting steps.

In order to reach government mandated SAF usage, companies will have to increase their consumption levels at a CAGR of 87% through 2030 and several have already set internal commitments to go beyond this. FedEx (NYSE:FDX) has committed to using 30% SAF for its planes and UPS (NYSE:UPS) 30% by 2035, while American Airlines (NASDAQ:AAL), British Airways and Alaska (NYSE:ALK) have set a target for 10% SAF in the mix by 2030.

NXTCLEAN claims to have “negotiated” offtake agreements equal to 90% of its expected production but this phrasing implies that it has less than this amount under firm contracts. It estimates its total contracted revenue at $7.2 billion over its first five years and it has entered into a term sheet with an unnamed airline for 200 million gallons per year of production.

Its own supply appears to be more concretely shored up. BP (NYSE:BP) has signed a term sheet that would supply 100% of the feedstocks needed for the first five years of NXTCLEAN’s operations and plans to invest in the company, according to the company’s investor presentation.

NXTCLEAN is working on agreements to pull in alternative feed stocks like cooking oil and biomass from agricultural waste, and these may be necessary to maintain the sustainable mantle. But, it believes the BP supply can get it to $1.9 billion in revenue and $587 million in EBITDA in its first year of operations in 2026.

It expects to generate more than $2 billion in revenue and over $1 billion in EBITDA in each of the three years that follow. But, it must first spend $3 billion to build the facility and it remains unclear how these capital needs will be fulfilled. Even with zero redemptions, this deal as currently conceived would provide a maximum of $243.5 million in cash proceeds.

Additional project financing may be available down the road, but investors must also consider that NXTCLEAN’s site will likely receive final regulatory approval only after this transaction has closed.

But, this deal has an attractive precedent in Archaea Energy (NYSE:LFG), which completed a combination with Rice Acquisition Corp. in September 2021 and traded well before agreeing to be acquired by BP for $26 per share. BP could potentially see a similar move in its interests down the road with NXTCLEAN given that it is already its proposed supplier.

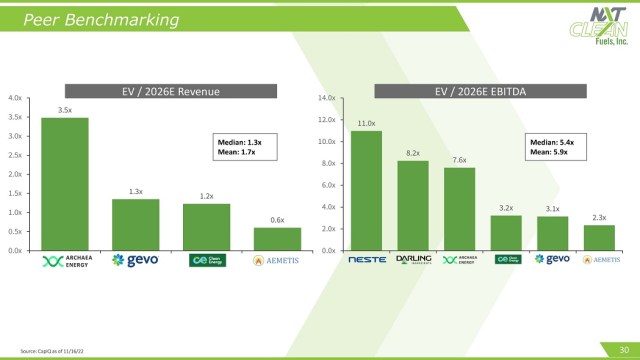

NXTCLEAN still has plenty of homework to complete before then, however. From its current standpoint, the deal values the company at 0.27x its 2025E revenue and 0.9x 2025E EBITDA. Archaea meanwhile trades at 3.5x 2026E revenue and 7.6x 2026E EBITDA, but many of NXTCLEAN’s other public comps have not even published projections that far out.

The largest of these competitors, $36 billion-market cap Neste Oyj (HE:NESTE) trades at 1.6x its 2025E revenue and 10.4x its EBITDA projections for that year. Gevo (NASDAQ:GEVO), which is more comparable to NXTCLEAN’s scale with a market cap of about $540 million, trades at 1.3x its 2026E revenue and 3.1x EBITDA.

Click here for the full investor presentation.

ADVISORS

- England & Company is acting as financial advisor to ITAQ.

- ArentFox Schiff LLP is acting as legal counsel to NXT.

- Ellenoff Grossman & Schole LLP is acting as legal counsel to ITAQ.