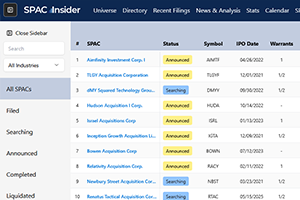

Tracking the Ebbs and Flows of Warrants and Rights on SPACInsider+

As the SPAC market reset began last summer, many attributes of what constituted the typical SPAC template began to change. For one, rights came back in a big way. During the previous cycle, SPACs with warrants heavily outnumbered those with rights. Rights tended to be more commonly found in the units of smaller, Asia-based SPACs

Read More