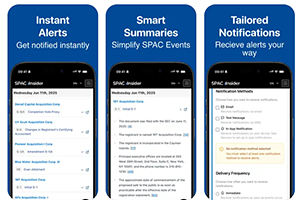

Morning SPAC News Roundup: July 22, 2025

At the SPAC of Dawn Monday’s busy action nearly doubled July’s count of new business combinations with the three new deals bringing the month’s tally to seven, surpassing the five announced in June and three in May. Those deals came in just before some series of fresh comments by Fed officials that will surely be

Read More